The Big 4 Banks Tussle It Out For Market Share Following APRA Announcements

There is a lot of press at the moment about the big 4 banks increasing their interest rates for investors in response to regulatory action from APRA. Most recently we saw Westpac increase their rates for Investors last Friday by 0.27% off the back of similar moves by ANZ, Commonwealth and NAB.

We get asked a lot where we think interest rates are headed, and in this instance whether we have seen a turning point in the interest rate cycle. This is an interesting question with lots of differing opinions and commentary. Here at Riveren, we are more focused on data rather than opinions, so in answering this question we look to the best forecast available to us – the market.

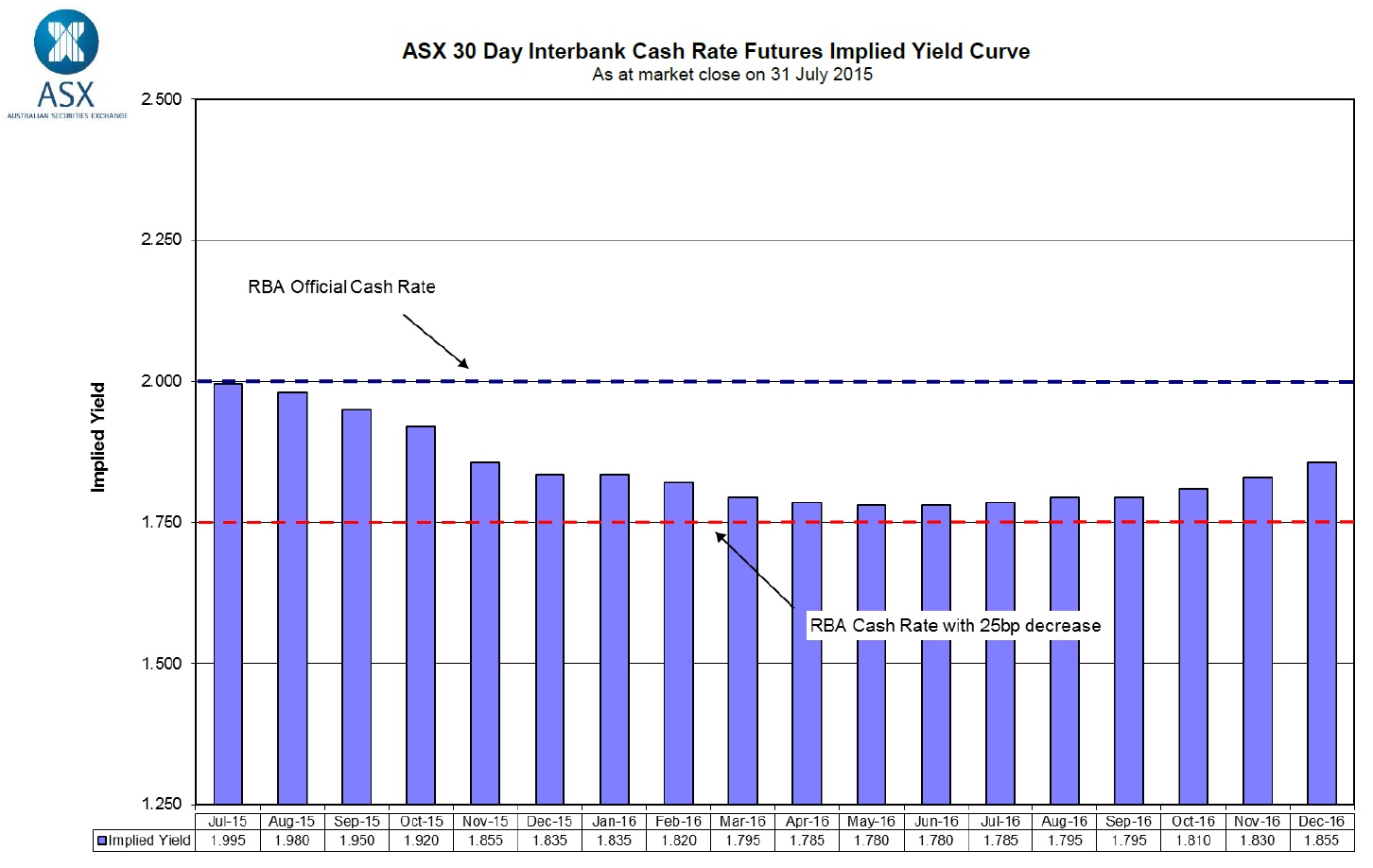

The ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve is a financial instrument that provides a proxy for the market’s view of where the RBA cash rate is headed over the next 18 months.

Looking at the chart above, you can see that the market is pricing in a further 0.25% decrease in interest rates sometime in the next 12 months, without much change in the 6 months following.

So the market is telling us that the RBA is likely to keep interest rates relatively steady over the next 18 months, with some chance of a 0.25% decrease. This is relatively good news for property owners and investors. However, as all the Riveren investment property specialists know, property is a long term investment and your ability to hold property over the long term is what drives growth.

Always ensure you undertake scenario analysis and stress testing to ensure you can comfortably hold your asset when interest rates normalise at higher levels over time. If in doubt, contact one of our specialists for professional advice and guidance.