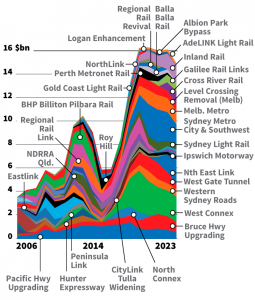

Australian industry research and forecasting consultancy Macromonitor predicts investment to soar over the next three years to run at more than $16 billion a year. Australia’s infrastructure boom (particularly transport infrastructure) is set to get stronger for longer.

Major benefits of infrastructure growth in the economy, overall consumer confidence and the clear correlation to the property industry are not new concepts.

Transport infrastructure remains critical to property investors; to highlight, road upgrades such as Melbourne’s North-East Link, Sydney’s WestConnex or the Gold Coast’s Light Rail play a critical role in driving up property values, as these projects make cities and areas more accessible and create greater demand around the interchange areas of the projects.

The infrastructure investment surge arrives as housing construction starts to cool, more than compensating for the slight slow down and extending Australia’s extraordinary run of unbroken economic growth.

The infrastructure investment surge arrives as housing construction starts to cool, more than compensating for the slight slow down and extending Australia’s extraordinary run of unbroken economic growth.

Not only do infrastructure upgrades, projects and investment increase employment, local property values and rental yields, but they also provide indirect benefits to the community such as consumer expenditure and social benefits of community development– all of which drive demand.

Such infrastructure projects mentioned in Michael Pascoe’s article in The Age will make sections of Australia’s major cities ripe for long term capital growth, serve as strong indicators for long term employment growth, and thereby have a strong impact on future property prices and investment opportunities.

With the infrastructure mini boom here to stay, now is the time to invest! Book a free consultation with our property investment specialists today via this link.

*Reference image from http://www.theage.com.au/business/the-economy/the-infrastructure-boom-cometh-20180205-p4yzey